The money jars system is an easy and simple way to manage your money. In the beginning I resisted this system. Eventually I gave in and began to see the financial rewards first hand. In my last post I shared some of the benefits of using the JARS to manage money. In this post I’ll cover my experience on how the jars work.

You might also like this: Wealth Blueprint

Why Physical Money JARS?

I’ve had a few people ask me why I have the physical jars sitting on my desk. Some have asked, “Steve, do you actually put money in those jars?” The answer is, ‘it depends’. Let’s explore the question in more detail.

Currently, I have setup the jars electronically so that all transactions are completed automatically on a monthly basis. Most of the work is done online. From this stand point you might think that there is no need for the jars. One of the reasons I have the jars on my desk is because they help me build the habit of managing extra money. Keep in mind that visual is memorable. The jars are a physical reminder of where my money is going.

Sometimes I run into extra cash or happen to find change in my pocket when I get home from work. When this happens I place the cash into one of the jars. Most times I’ll place the money into the FFA jar -the jar used to build our nest egg.

The physical action of placing the money into the jar is important. Once I place the money into the jar it gets me thinking about ways to use that money. For instance, when I place money into my FFA jar it triggers my sub-conscious to find ways to invest. The action of putting the money in the jar is like planting a seed. Once the seed is planted my mind works on creative ways to invest.

Sometimes I’ll place my extra money into the PLAY jar. Similarily, this will trigger my thought process to find ways to spend money on play. It’s like a game. Every time I put money into one of the jars my mind starts working to find ways to spend that money. This process is a great way to build your money managing habit.

Paying Debt

Unfortunately, most people don’t use a system like this and they tend to always be in debt. One of the reasons they’re always in debt is because they use their extra money to pay their debt. If you’re consistently using extra money to pay your debt then you’re teaching yourself that habit – to pay debt.

The more you do it, the better you get at it. Eventually this habit becomes ingrained in you and it happens unconsciously. This habit can also lead to a poverty consciousness. The more times you pay your debt, the more you think about it. The more you think about it, the more you feel it. This will attract more debt. The way to move away from debt and into prosperity is to setup an automatic debt payment program.

The Money JARS

As a recap, here are the money jars and a short description of each one.

> Necessity Account (NEC – 55%): This account is for managing your everyday expenses and bills. This would include things like your rent, mortgage, utilities, bills, taxes, food, clothes, etc. Basically it includes anything that you need to live, the necessities.

> Financial Freedom Account (FFA – 10%): This is your golden goose. This jar is your ticket to financial freedom. The money that you put into this jar is used for investments and building your passive income streams. You never spend this money. The only time you would spend this money is once you become financially free. Even then you would only spend the returns on your investment. Never spend the principal or else you’ll go broke!

> Education Account (EDU – 10%): Money in this jar is meant to further your education and personal growth. An investment in yourself is a great way to use your money. You are your most valuable asset. Never forget this. I have used education money to purchase books, CD’s, courses or anything else that has educational value.

> Long Term Saving for Spending Account (LTSS – 10%): The money in this jar is for the bigger nice to have purchases. As I said in my last post, Trisha and I are going to Whistler, BC in January 2008. The only reason we’ve been able to make this happen is because we’ve accumulated a nice sum in our LTSS. A small monthly contribution goes a long way.

> Play Account (PLAY – 10%): This is my favorite account. PLAY money is spent every month on purchases you wouldn’t normally make. The purpose of this jar is to nurture yourself. You could purchase an expensive bottle of wine at dinner, get a massage or go on a weekend getaway. Play can be anything your heart desires. I’ve spent my play money on a night of sake and sushi at a Japanese restaurant; hockey equipment that I didn’t really NEED but wanted; a night out on the town with a limo, champagne, etc.

> Give Account (GIVE – 5%): The money in this account is for giving away. Trisha and I give money every month to the Sick Kids Hospital Foundation. We also use the money in this jar to give to family and friends on birthdays, special occasions and holidays. You can also give away your time as opposed to giving away money. You could house sit for a neighbor, take a friends dog for a walk or volunteer in your community. When you give your money or time you’re sending a sign of abundance to the Universe. You’re telling the Universe that you have plenty of everything, you’re abundant. Giving signals abundance. This will magnetically attract more abundance to you.

How the JARS Work

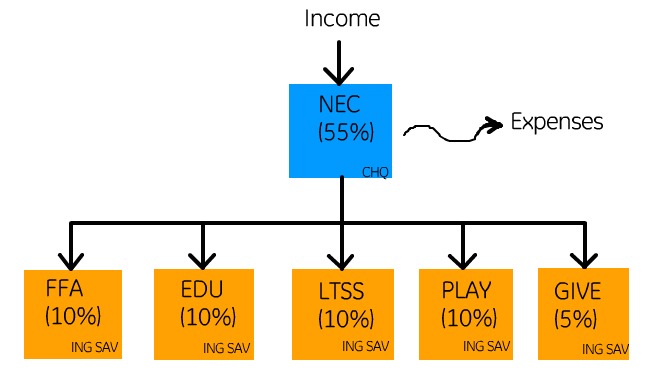

Here is a sketch of how we use the jars. Trisha and I deposit all of our personal income into a necessity account. In our case it’s our checking account. The money in our necessity account pays for all of our expenses. The remaining money is distributed into 5 other accounts. See the sketch below.

I learned very early in the process that the jar percentages are not critical. To guarantee your financial success just start using the jars and build the habit. This is key. It doesn’t have to be perfect when you start.

You could even start by splitting $10 every month into the jars. There is an inspiring story in ‘The Secrets of the Millionaire Mind’ about a woman who started splitting $1 into the jars every month. In her first month she put 10 cents into her play account, 10 cents into her FFA, 10 cents into her LTSS and so on.

Later that month she used her play money to buy a piece of bumble gum. She received a mini comic with the bubble gum package that she bought with her play. She read the comic and got a laugh. Two years later she deposited a $10,000 dollar check into her FFA account. Now who’s laughing?

If she can do it then so can you.

I highly recommend the JARS system to anyone who wants to make the most out of their money. If you’re looking for a simple way to make more on what you already have then use this system. T. Harv Eker teaches you exactly how to use the JARS System in his book, Secrets of the Millionaire Mind.

39 Comments

Yi Hui@The Simple Wealth

February 1, 2008I like this system very much. I have been feeling that I need a system to build financial freedom but putting it off because of tight budget. Thank you for sharing it. I’m going to use it.

Steve

February 2, 2008Yi,

That’s great to hear! My intention is to share this system with as many people as possible as it has had a massive impact on my life.

Good luck!

Alicia Nunes

February 20, 2008For the JARS system; I would like to know if you take all of you and your significant other’s income and pay your monthly bills with it 1st, then divide the income after paying all of your monthly bills. I was under the impression that you are to take your income and then split it up and 55% is for necessities, which you would use to pay your bills. Could you please clarify for me. It would be greatly appreciated, so that I could understand the system correctly. Thanks! (:

Dawn

April 13, 2016Your impression was correct, but you can do it either way. Ideally, you break up your total income and pay bills from NEC (55%). If that’s not possible, look at reducing your monthly bills.

I do pay my bills first then divide the net income to create budgets for my business accounts.

Steve

February 20, 2008Hi Alicia – thanks for the question.

We have one account (RBC Savings Acct) where we deposit all of our earned income. We then withdraw all of our money from this one savings account into these 5 accounts:

FFA

EDU

LTSS

PLAY

GIVE

The balance of the money stays in our RBC savings account and is used to pay for all our necessities (NEC) including monthly bills.

As for the percentages, we normally try to keep the percentages close to the values recommended by Harv but there is no hard and fast rule. We generally have put 55-60% in NEC and 20-25% deposited into our FFA. The rest is split depending on what is left.

If you just start splitting the money (regardless of the recommended percentages) I guarantee you’ll start to see results. The important thing is to build the habit.

Alicia Nunes

February 20, 2008thanks :)

Steve

February 20, 2008Your welcome – I love to hear success stories so let me know how you progress….

Leah Q.

March 11, 2008You should check out the finance section at ezinearticles.com your articles would be an added asset there and would reach many more people – good read and advice! I happened to stumpleupon.com your site….and might even follow your sage advice too! Keep up the great work –

Reg

March 11, 2008Read your article.

Liked your article.

Printed your article.

Clicked a couple of your google ads.

Keep up the good work.

Reg of http://www.elementaltruths.com

Steve

March 11, 2008thanks Reg.

I love the way you wrote your comment – it’s original.

Steve

March 11, 2008Leah – thanks for the tip.

I’m taking your advice and checking out ezinearticles.com

Ash

March 13, 2008I’m only 21, but I think this system could truly apply to me as well. I would like to say though, is it ever difficult to fight the urge to put an extra percentage into the PLAY or LTSS jars and even scrimp on the GIVE jar?

I can imagine that’s something I’d be tempted with.

This idea has really intrigued me though, and although I live at home with my parents and pay a meagre rent, giving them 55% of my income instead of the 20% (roughly) that I give them now, would not only really please them, but it’d make me feel more secure overall.

Steve

March 13, 2008Hey Ash,

I find this concept difficult to learn unless it’s experiential. I’ll be posting details on how you can sign up for the MMI and learn more about the jars system.

Paul Piotrowski

January 8, 2009Very cool! I read Harv’s book a long time ago but totally didn’t see that system in there. I think I wasn’t ready for it.

I’m going to figure out a way to implement this and try it out.

Thank you for bringing it to my attention!

Great site, btw.

-Paul

Steve

January 8, 2009Hey – thanks Paul!

cathy

February 5, 2009I really like this idea and I am trying to figure out the best way to apply it.

When you say….

“We have one account (RBC Savings Acct)…We then withdraw all of our money from this one savings account into these 5 accounts:

FFA

EDU

LTSS

PLAY

GIVE

Do you place them in “Actual” bank accounts?

If yes, do you miss out the additional compound interest that you would receive by keeping all your $ in One account?

Steve

February 5, 2009Hi Cathy – no, not really. We don’t miss out on the compound interest.

Our four accounts (FFA, EDU, LTSS, GIVE) with PLAY being the exception, are all high interest ING accounts. There is no fee for each account and since each ING account is high interest, each account accumulates its’ own interest.

All that being said, this is a minor benefit. The main benefit is building the habit to channel your money and use the JARS system. When you do, the money will begin to pool into reservoirs so you can build true wealth, and eventually become financially free ;)

cathy

February 5, 2009Ok, so the only question I have left is where do you put your Emergency fund. 8-12 Months of the NECs. That doesn’t get touched no matter what?

Steve

February 6, 2009The emergency fund is 50% of the LTSS. Harv explains this in more detail in his book: Secrets of the Millionaire Mind.

maria brophy

February 7, 2009I read Harv’s book sometime back but never warmed up to this idea until today, after reading your article. Thanks – you explaind it very well, and the questions people asked helped me, also. I’m going to set up my ing accounts right away!

Steve

February 8, 2009Good on ya Maria

– it will definitely make a difference in your life.

Kelly Flack

February 14, 2009Hi Steve,

This is AWESOME my friend. I can especially relate to how the physical action of placing the money into the jar is important as it can trigger the sub-conscious to find ways to ‘invest’ or ‘play’ or whatever the JAR may be for.

I am teaching my experience with tips and techniques relating to the law of attraction. We have now come to the LOA and money part and from the SOGR forum, I have now come to this page.

I firmly believe that coincidences do not exist, so I will be sending my learning subscribers from http://powerfultools4life.synthasite.com to this page. Their ‘action plan’ for the day will be to read your awesome article and go out to find themselves some jars :) Thanks mate! Muchly appreciated.

Miria Lauroel

January 30, 2010Steve, another great article. I am going to set this system up immediately. I am so glad I found your site. You are presenting some ideas I have not come across before that are powerful and wonderful. I am so grateful to you. I have bookmarked your site and will be returning often.

Nicole Darlaston

February 26, 2010My sister is a proponent of this method and has been using this system for several years. Her beliefs in energy transformation have yielded her tremendous success professionally, financially and spiritually. I am becoming more accepting of these ideas as when I am open to positive change I begin to receive unexpected opportunities. I am happy to have found your site. Thank you.

gregory

May 7, 2010Hey,

Thank u so much for this! As soon as i finished reading this article, i instantly went to the mall to buy a set of jars. I bought coffeejars actually. When i went home, my mother told me that she was looking for those kinda jars to put sugar, salt, etc in it because u can look through it. She began telling me that i shouldn’ve bought them anyways, because she still has other jars somewhere put away. So i said her that i’d trade them if she wanted to. She loved it. She was looking for those lookthrough jars for quite some time hehe. She thanked me and guess what: she gave me my money back for whatever i had spend today for that. Kinda amazing when u come to think what my intentions were by buying those jars. U can guess it hehe.

So i put her money into the “give-away-jar” & i’m very happy that i can pass that money on to someone else this month.

Anyone reading this… I really recommend this system. Just start doing it no matter how much money u have right now. It completely changes the way u think about your money through your actions. I can already see the many advantages & opportunities with this and i only started today!!!

Many thanks!!

Greetings from Belgium

Greg

Eduardo

July 8, 2010looks similar to Frederic Lehrman’s Prosperity Consciousness program!

Great stuff!

bartkiewied

April 4, 2011i was on the M.M.I in the netherlands this year.

It was great!!!

on cuestion i have 2600 euro and nec is 1800Euro

this is more than 55% what now??how do i split

Steve

April 4, 2011Yup… they would have taught you this at the MMI… the percentages are just a GUIDE… so it doesn’t matter that you’re over the 55%… what matters is that you START using the JARS!

Melvyn

November 10, 2011Hi Steve,

I am a real estate agent on commission based income.

How do i split my commission into the jar systems since i have business expenses and personal?

I used to split all my commission into the 6 jars and use the necc jar for both business and personal necc.

Giovanni

November 8, 2012Try the app iMoneyJars for iPhone.

https://itunes.apple.com/us/app/imoneyjars/id544710576?mt=8

the ball game

November 13, 2013This is a great tip particularly to those new to the

blogosphere. Simple but very accurate info… Thank you for sharing this

one. A must read post!

Hoang Ngo

July 23, 2014Here the first app can help you manage your money by JARS system, let take a try and give me feedback (if can) so I can improve it. Thank you so much.

https://itunes.apple.com/us/app/6jars/id892331769?ls=1&mt=8

Mirja

June 16, 2018Hi,

I am intressted in the app for the jar system, but live in Sweden and can not buy or download it, any suggestions?

// Mirja

Steve

July 23, 2014That’s so crazy Hoang! Great job :-)

Kathleen

May 30, 2015I have been doing this for about six months and if you are not doing it you should.. What a difference it makes !

BoYee Nataraja

November 9, 2015Hi Steve,

Thank you SO MUCH for writing this blog. My jars are all set up will my money divided and placed into each jar accordingly.. However, I just came up with a mental block.. I am in the process of starting a couple new businesses.. they were hobbies before, but I want to make them real businesses now.. So do I need a serrate business jar?? Like, from which jar am I allowed to pull out money to use to invest into my business. And, with the profits of my business, what percentage of it do I use to pay myself, and what percentage do I put back into my business? If you can help me answer this question, I would MUCH appreciate it..

BoYee

Preston Lund

October 5, 2016I’m doing this! Not sure how it will work spending the money for example in the Play Account or Education Account. Do online banks let you have multiple separate savings accounts? And do they give you a Debit Card for Savings accounts? Or would I have to transfer my Play Account money from that savings account into my checking account to spend say at a high end restaurant or buy a book on Amazon for education?

[…] to his website on how to use these jars. Hope this helps anyone who’s in debt, trying to get out of debt, […]

[…] Imagen de freedomeducation.ca […]

Leave A Response